Optimize Every Onboarding, Eliminates fraud at every touchpoint

Early and precise investigation at each stage, ensuring your KYC spend is optimized, without compromise.

Early and precise investigation at each stage, ensuring your KYC spend is optimized, without compromise.

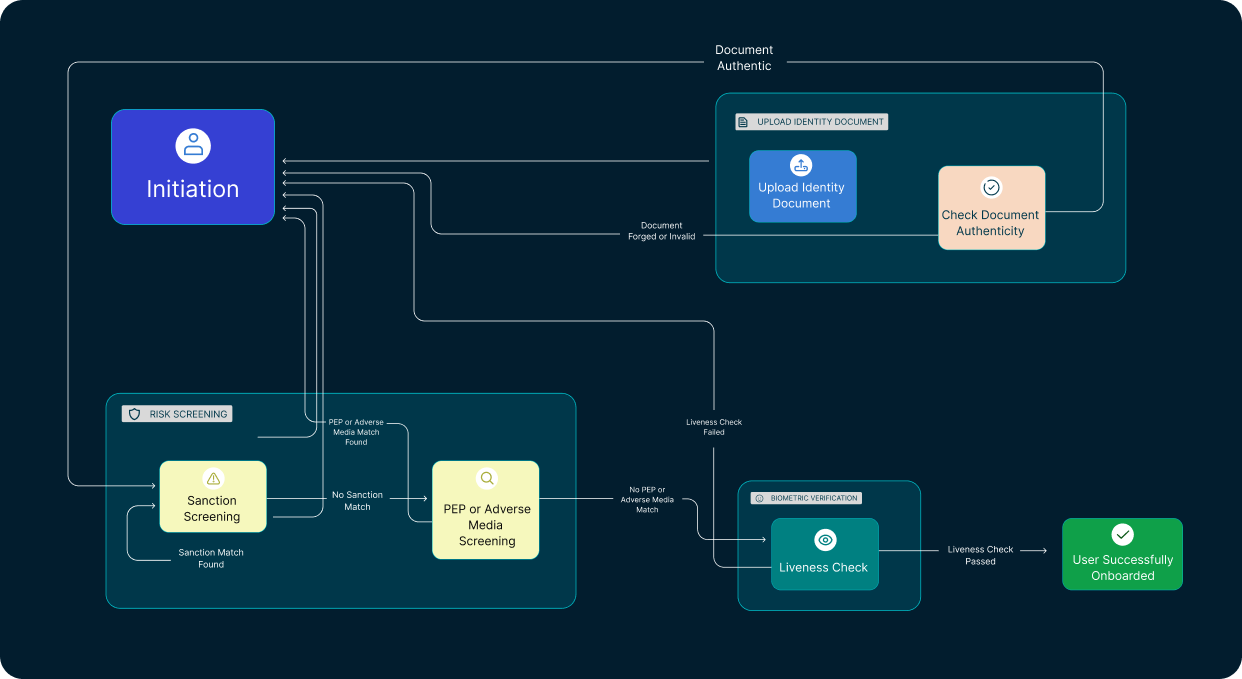

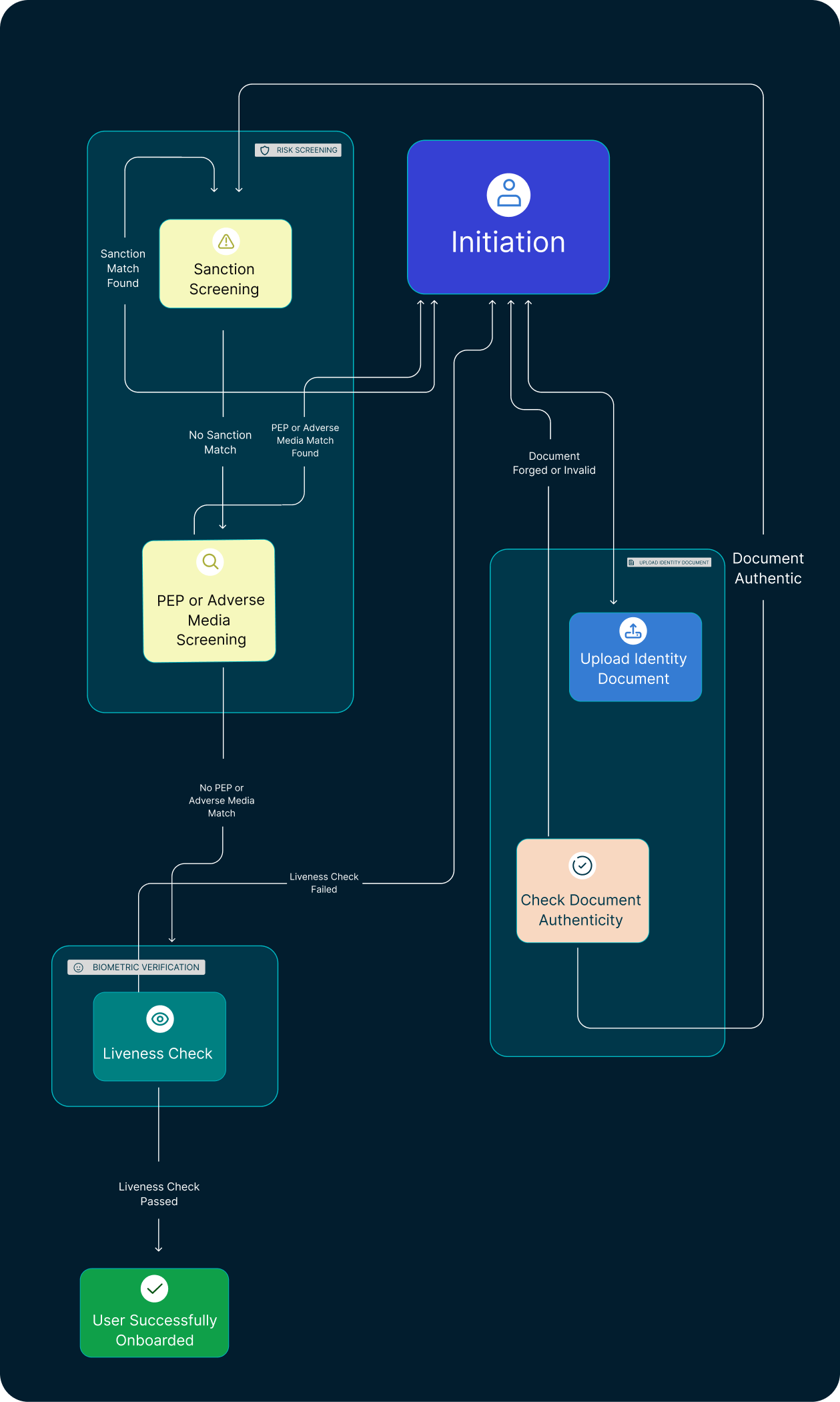

The customer begins their journey by easily uploading their identity document. This initial step is designed for speed and user convenience, with minimal cost.

Request Demo →The system immediately verifies the authenticity and quality of the submitted document. If the document is detected as forged, invalid, or of insufficient quality, the process intelligently loops back to the user or is flagged for immediate rejection.

This crucial early-stage check prevents unnecessary expenditure on subsequent, more intensive (and costly) screenings like PEP or Sanctions if the foundational document is compromised.

Request Demo →

Upon successful document authentication, an automated and thorough sanction screening is performed. Any detected sanction matches will immediately halt the process, guiding it back to re-initiation or rejection based on your configured risk policies.

You only pay for this check once the document is deemed authentic, ensuring a smart spend.

Request Demo →Following a clear sanction check, our platform conducts Politically Exposed Person (PEP) and adverse media screening. Should a match be found, the process cycles back or terminates, addressing potential risks without proceeding further.

Again, this targeted check is only initiated after preceding stages are cleared, optimizing your verification spend.

Request Demo →

A critical step in real-time fraud prevention, the liveness check verifies the user's presence. A failed liveness check immediately prompts the user to attempt again or leads to a rejection, preventing costly onward processing for fraudulent attempts.

Request Demo →Once all verification steps are successfully completed and cleared, the user is seamlessly and securely onboarded. In case of rare failure, back office users and customers are notified for manual review

Request Demo →

Choosing RemitSo means investing in a KYC solution that goes beyond mere compliance.

Don't pay for what you don't need. Our intelligent, staged verification process ensures you only incur costs for checks as users progress, significantly reducing wasted spend on fraudulent or unqualified applicants from the outset.

Our streamlined flow significantly cuts down onboarding time, providing a smooth and intuitive experience for your genuine customers. This reduces drop-off rates and improves customer satisfaction.

Leverage real-time digital intelligence, advanced liveness detection, and robust document analysis. We identify and mitigate threats early, protecting your business from financial loss and reputational damage.

Stay ahead of evolving global AML/KYC regulations. Our platform is continuously updated, providing the comprehensive audit trails and robust reporting you need for confident compliance.

Tailor every aspect of your KYC workflow to match your specific risk appetite and user journey requirements with our flexible, no-code configuration. Maintain complete control without sacrificing efficiency.

Whether you're onboarding hundreds or millions, our platform scales effortlessly with your business, ensuring consistent performance and security as you expand.