White Label

Remittance Software

Launch Your Branded iOS and Android Apps and Start Processing International Money Transfers in 30 Days

Launch-Ready Global Remittance Platform

Trusted by companies worldwide

🚀 Your Go To Market Timeline

-

1

DAYS 1–5

📋 Kick-off & Discovery

You receive our onboarding checklist. After you fill it out, we schedule a kick-off call to finalize all remaining requirements, understand branding, app design (UI/UX), and plan your server setup.

-

2

DAYS 5–10

⚙️ Initial Setup & UAT

We deploy your staging server, admin panel, and web app. Your system is ready for User Acceptance Testing (UAT).

-

3

DAYS 10–15

🌐 Web Go-Live & App Staging

Web portal is now ready for UAT and can go live for transactions. Simultaneously, we deliver the first testing build of your branded mobile app for your review.

-

4

DAYS 15–20

✅ Feedback & Pre-Production

We implement your feedback from UAT and move the tested web and mobile apps to a secure pre-production environment for your final sign-off.

-

5

DAYS 20–27

🚀 Production & Submission

After your final sign-off on pre-production, we deploy your live production server. We then manage the complete app submission and approval process.

-

DAY 30+

🎉 Mobile Apps Live!

Once your apps are approved by the stores, they are live. You are now ready to onboard customers from every channel and scale your business.

An All-Inclusive Platform

Everything you need to run a global remittance business.

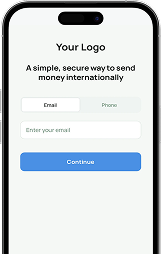

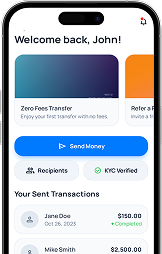

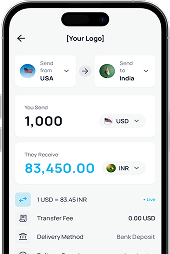

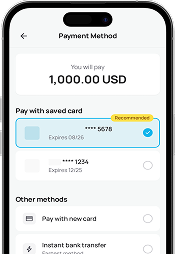

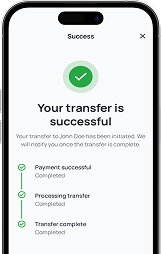

Mobile Apps & Website

Real-Time Alerts

Push notifications for transaction updates and promos.

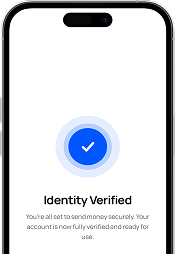

Secure Login

Biometric (FaceID/TouchID) and PIN based access.

Digital KYC

Seamless UI for document upload.

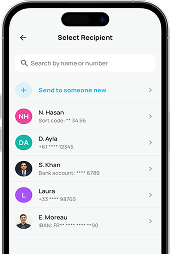

Recipient Management

Save beneficiaries and repeat transfers in one click.

Transaction History

Complete detailed history with downloadable receipts.

In-App Chat

Support widget interface.

From Launch to Global Scale

Complete ecosystem of tools, partnership & support

Start as a Money Transfer Business

Go live in the US, Canada, Australia, Brazil & the Eurozone in under 30 days. Even if you don't have a license, we've got you covered.

Global Partnerships

Leverage our pre-integrated network of essential services—including global payouts, payment gateways (pay-ins), and KYC providers.

Your Brand, Our Engine.

Launch your own remittance service with our licenses arrangement, banking, and technology.

MSB Bank Account

Struggling with high-street banks? We connect UK-based Money Service Businesses with stable, reliable banking partners who understand your needs.

Managed Compliance

End-to-end compliance support—from initial required licensing paperwork and program design to ongoing management and independent reviews.

We’re Here to Help

Questions? We’ve got answers. Whether it’s a quick query or a detailed request, our team is ready to assist you through the method that suits you best.

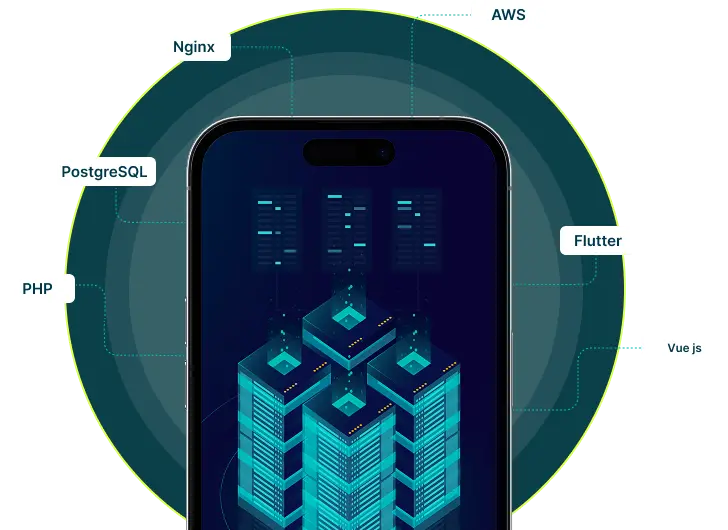

Technology Overview

Architecture

Built on the reliable AWS cloud leveraging, AWS SQS/SNS/SES

Performance & Reliability

AWS Lambda for serverless computing, RDS databases, and S3 for storage

Updates & Stability

Laravel Vapor for smoother updates, greater stability, efficient user experience

Engineered for Scalability

AWS Lambda and asynchronous processing (SQS), to handle high transaction volumes and manage peak times.