If you work in compliance, you’ve probably come across situations that raise questions. Maybe a new customer in the UK starts sending large amounts of money overseas just days after joining. Or an old, quiet account in Canada suddenly shows lots of deposits and withdrawals. Something feels off.

In 2025, compliance teams in the US, Europe, Australia, the Middle East, and beyond are under more pressure than ever. Regulators don’t just want to see that you have a transaction monitoring system, they want to know that you’re using it properly.

That’s where red flags come in. These are warning signs that a transaction might be suspicious. Nowadays, spotting these red flags is what separates a strong AML compliance program from one that’s at risk.

In this article, we’ll walk you through 25 real-world red flags that should be part of your transaction monitoring AML checklist.

| Red Flag Type | What It Signals |

|---|---|

| Structuring | Attempts to avoid detection by breaking large amounts into smaller ones |

| Unusual Behavior | Transactions that don’t match the customer’s usual or expected patterns |

| Geographic Risk | Transactions involving high-risk or sanctioned countries |

| Transaction Flow Patterns | Quick movement of funds, mirror transactions, or unexplained volumes |

| Business Profile Mismatch | Behavior inconsistent with stated purpose or business type |

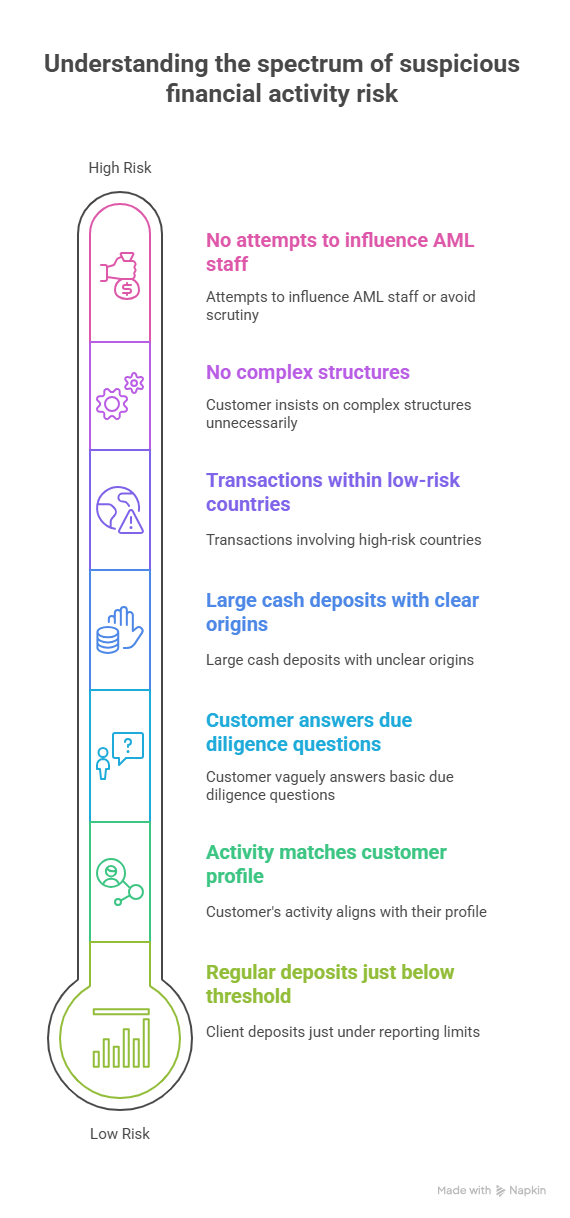

If a client consistently deposits $9,800 in a jurisdiction with a $10,000 reporting trigger, it’s worth reviewing. This is a common structuring tactic to avoid detection.

When money enters an account and leaves again almost immediately, especially internationally, it may indicate layering, a step in the money laundering cycle.

If an account that’s been quiet for months suddenly sees high-volume transactions, investigate. This is often linked to account takeovers or misuse by criminal networks.

Frequent address or contact detail changes, or pushback during onboarding, could mean someone’s trying to hide their identity or move money anonymously.

A student account receiving business-level wire traffic? Or a retiree funneling crypto through six exchanges? Those are examples where transaction monitoring systems should flag and escalate the behavior.

When a business receives payments from individuals or companies that don’t make sense based on its operations, it’s a signal. For instance, a local furniture business receiving large transfers from multiple overseas firms with no clear explanation? That’s a red flag.

It’s not just about refusing to submit documents—some customers give vague answers or deflect. If someone hesitates to explain the source of funds or nature of their business, don’t ignore it. They might be trying to hide something.

Cash is still king when it comes to money laundering. If a customer walks in with stacks of cash but no real explanation especially if they do it often it’s time to dig deeper.

This one’s straightforward. If funds are moving to or from jurisdictions flagged by FATF or your local regulator, your system needs to raise a flag. This includes places like North Korea, Iran, or even certain zones in Eastern Europe under watch.

Moving money back and forth between accounts might be fine once or twice—but if it becomes a pattern, it could signal layering, commingling of funds, or an attempt to disguise transaction trails.

If a client sets up multiple shell companies or trusts just to make a simple transaction, they might be trying to mask the true owner or purpose. This is common in tax evasion or money laundering attempts.

There’s nothing wrong with going global—unless it doesn’t make sense. If a small local firm suddenly starts sending money to five countries with no ties to its operations, that deserves attention.

Let’s say a client who normally moves $10K per month suddenly pushes $500K through their account in a week, with no change in business model or explanation. That’s an anomaly that shouldn’t be ignored.

Legitimate businesses have real physical addresses. If a customer is routing all communication through PO boxes, drop-off points, or co-working spaces with no clarity, it’s suspicious.

These tools aren’t bad in themselves, but heavy usage—especially without controls—can be a way to move money under the radar. Your transaction monitoring AML setup should catch this.

Watch out for generic or repetitive descriptions like “services rendered,” “consulting,” or “business expense” for large transfers. If the labels don’t match the client’s profile, probe further.

Some clients learn the system and stay just under the radar intentionally—especially with structured cash deposits, wire transfers, or foreign exchange. Consistent near-threshold activity is a pattern worth watching.

When a customer moves funds to someone they have no visible relationship with—or receives funds from such a party—it’s not always sinister, but it should be reviewed.

Transfers of $5,000 exactly, five times a day, every week? Or repetitive transfers that seem pre-programmed? These behaviors often point to automation or attempts to keep transactions “clean” for laundering.

Money comes in—and is gone within minutes or hours. This rapid movement, especially across multiple channels (ATM, wires, crypto), is a common part of layering schemes.

If your client is a small food vendor but is sending daily wires to accounts in Dubai and Hong Kong, that’s worth questioning. Cross-border wires come with a higher risk and need a valid reason.

Changing addresses, phone numbers, and even email accounts repeatedly can suggest a customer is trying to stay ahead of scrutiny or spoof due diligence.

Industries like real estate, casinos, and import/export are naturally high-risk. If a customer is involved in one of these—and showing other suspicious behaviors—amplify your risk score accordingly.

If a client tries to pressure your team to rush onboarding, skip steps, or “just push it through,” that’s a behavioral red flag you can’t afford to ignore.

When identical amounts are sent between two or more accounts, especially in different currencies or jurisdictions, it’s often a laundering trick to disguise the source or route of funds.

| Severity of Red Flag | Action Required |

|---|---|

| Low | Monitor for trends, log internally |

| Medium | Manual review, update risk scoring, possibly escalate |

| High | Escalate immediately, consider filing SAR/STR, freeze if needed |

Red flags are behaviors or patterns in financial activity that suggest something could be off. They’re triggers that help your team investigate and prevent financial crime.

There’s no magic number. A strong transaction monitoring system should cover both general and industry-specific flags. The more customized it is to your risk profile, the better.

Not exactly. While the principles are global, the focus may differ. In the US, regulators watch for structuring and PEP exposure. In Europe, it’s about beneficial ownership. In Australia, it’s high-risk customers and links to foreign entities.

Absolutely. Not every flagged transaction is illegal—but every one deserves a closer look. That’s the point of having an AML compliance program in place.

That depends on the risk level. Some flags just need monitoring. Others require immediate escalation or reporting under your AML transaction monitoring process.