In 2025, creating a peer-to-peer (P2P) money transfer app can be a great business opportunity. These apps allow people to send and receive money directly from their phones or computers, making financial transactions easier and faster. Here’s a simple guide to help you build a P2P money transfer app.

P2P money transfer apps let users send and receive money without needing a bank. They are popular because they are convenient, quick, and often cheaper than traditional methods.

The market for P2P payments is growing quickly. It is expected to grow from $3.32 billion in 2024 to $3.78 billion in 2025. This growth is driven by more people using smartphones and wanting faster, easier ways to manage their money.

Digital Wallets and Bank Accounts: Users create a digital wallet in the app and link it to their bank accounts or credit cards. This makes it easy to transfer money between the app and their bank.

Transaction Process: When a user sends money, the app checks the details, follows legal rules, and processes the payment. The money can move within the app or through banking networks, depending on how the app is set up.

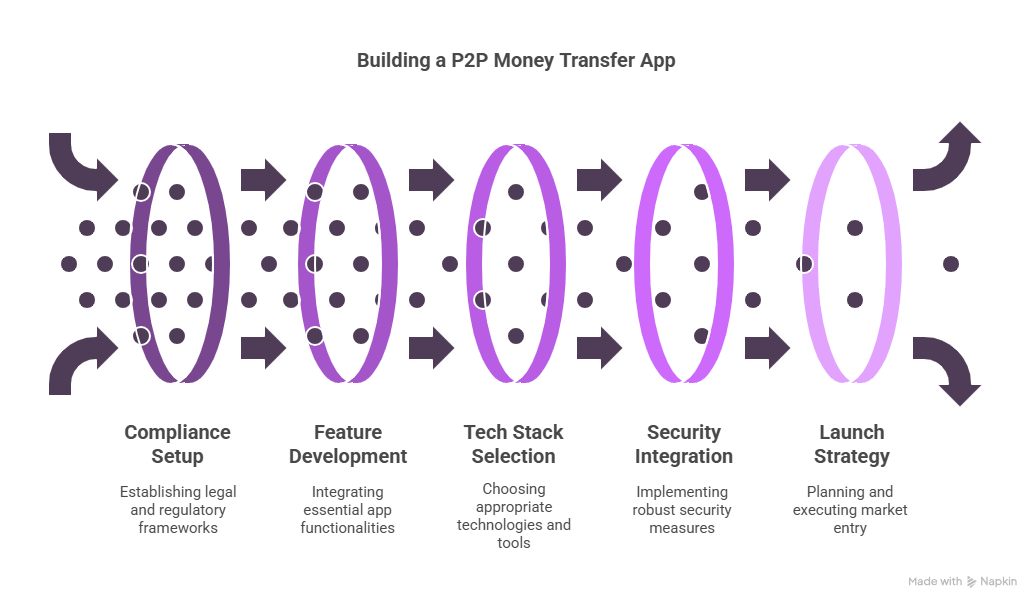

AML and KYC: Anti-Money Laundering (AML) and Know Your Customer (KYC) rules help prevent financial crimes. You need to verify users' identities, watch for suspicious activities, and report them to authorities.

GDPR and Data Security: In Europe, you must follow the General Data Protection Regulation (GDPR) to protect user data. This means having strong data handling and privacy measures.

| Feature | Description |

|---|---|

| User Registration and ID Verification | Secure onboarding with KYC compliance. |

| Send/Receive Functionality | Seamless transfer of funds between users. |

| Real-Time Exchange Rates | Up-to-date currency conversion for international transfers. |

| Transaction History | Detailed records of past transactions for user reference. |

| Push Notifications | Alerts for transaction statuses and promotional offers. |

Custom-Built vs White-Label Solutions:

| Option | Pros | Cons |

|---|---|---|

| Custom-Built | Tailored to your vision | Higher development costs |

| Highly customizable | Longer time to market | |

| White-Label | Faster deployment | Limited customization |

| Pre-built compliance & features | Dependency on vendor |

A strong integration strategy is key for a smooth money transfer experience.

Top Gateways to Consider:

Mobile Money Integration: For emerging markets, integrate services like:

These integrations make your app more accessible and expand its reach.

Security is crucial in fintech. Include these protocols:

Good design helps keep users. Here are some tips:

Pre-Launch Activities:

Go-to-Market Plan:

Features for Global Growth:

An app’s work doesn’t end at launch.

App Updates: Regularly fix bugs and improve performance. Bug Tracking: Use tools like Sentry or BugSnag. Feedback Loops: Collect user reviews and make improvements.

Building a P2P money transfer app in 2025 is about more than just technology. It’s about trust, security, and following the rules. From understanding legal requirements to integrating smart features and secure tech, there’s a lot involved in creating a top-notch money transfer app.

At RemitSo, we offer complete solutions to help you start your journey—from regulatory compliance consulting to powerful, customizable software that gets you to market faster. Our team is here to support fintech entrepreneurs who want to build the best money transfer app for 2025 and beyond. Learn more at RemitSo.

You’ll need licenses like FinCEN in the U.S., FCA in the UK, or an EMI license in the EU. Each place has its own rules.

It can take 3–12 months, depending on your model. White-label solutions are faster.

Costs range from $50,000 to $500,000+, depending on customizations, licensing, and regions covered.

Yes, but this adds more licensing and compliance complexity.

For quick entry and lower cost, yes. But for long-term uniqueness, custom builds are better.

In many places, partnering with a licensed financial institution helps with compliance and operations.