The global remittance industry continues to grow at a rapid pace, with the World Bank projecting global remittance flows to exceed $860 billion in 2025, driven by increased migration, digital banking adoption, and mobile-first financial services. At the same time, customer expectations are shifting—users want fast, low-cost, regulated, reliable, and transparent cross-border transfers.

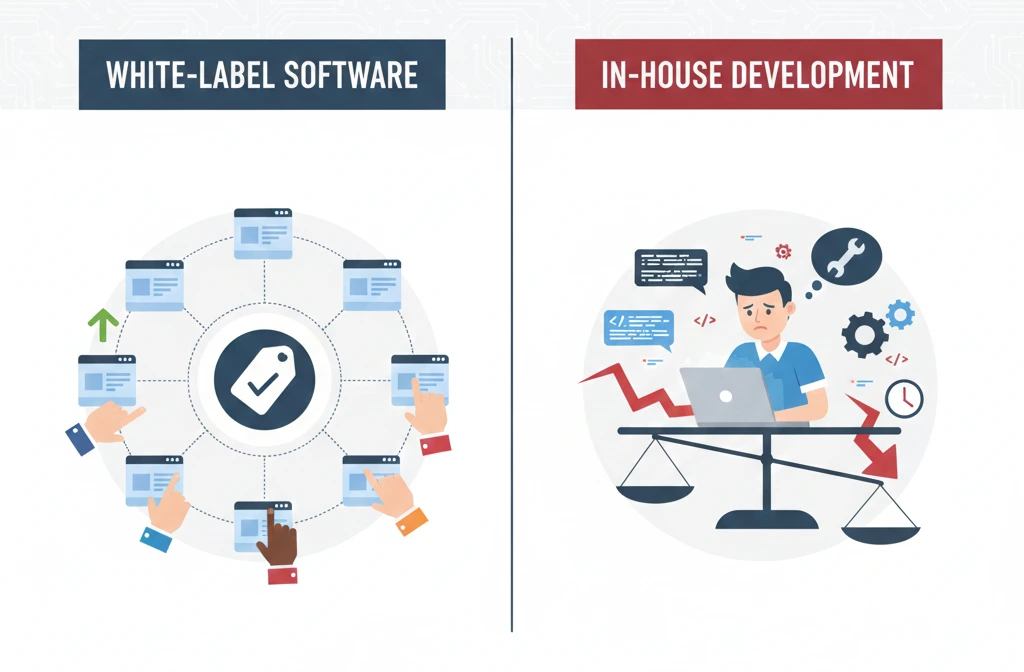

For businesses entering or scaling in the money transfer market, one critical decision shapes everything:

This 2025 expert comparison breaks down the real differences, costs, technical considerations, compliance responsibilities, and growth implications of both paths. This guide is written to meet EEAT standards, backed with insights from credible sources such as the World Bank, FATF, NIST, and industry benchmarks.

The money transfer and remittance industry is one of the most dynamic sectors in fintech today. Every continent has its own drivers and opportunities:

In regions like Sub-Saharan Africa, mobile-based remittances have transformed financial access — Kenya’s M-Pesa alone processes billions annually. Meanwhile, European startups are leveraging PSD2 and SEPA regulations to simplify cross-border payments. In North America, fintech disruptors are competing with traditional giants by offering faster, lower-cost solutions through app-based transfers.

Launching a money transfer business is not simply about building software. It involves:

Building all of this internally is possible—but extremely expensive and time-intensive. On the other hand, white-label solutions offer speed and significantly lower risk, but with limited customization.

This blog explains both paths in depth.

| Aspect / Pain Point | White Label Remittance Software | In-House Custom Development |

|---|---|---|

| Time to Launch | 3–6 weeks | 6–12+ months |

| Development Cost | Predictable subscription or licensing | $350k–$1.5M+ upfront |

| FX Rate Management | Built-in FX engine, automated margin control | Manual FX systems, higher risk |

| Fraud & Risk Management | Included fraud scoring, monitoring, velocity checks | Build scoring models & tools from scratch |

| KYC & AML Compliance | Integrated KYC/KYB/AML workflows | Multiple vendor integrations required |

| Transaction Scalability | Optimized for 10,000+ concurrent transactions | Requires internal DevOps expertise |

| Payout Network Access | 100+ countries pre-integrated | Negotiate & integrate each partner individually |

| Downtime Handling | Automatic failover | Manual single-partner dependency |

| Infrastructure | Cloud-managed | Fully internal management |

| Operational Visibility | Unified dashboard, analytics | Custom dashboards needed |

| Security & Certification | ISO/SOC included | Full audit responsibility |

| Ongoing Maintenance | Included | High ongoing engineering work |

White label remittance platforms are ready-made, customizable fintech ecosystems that allow financial institutions, money transfer operators (MTOs), neobanks, and startups to launch global money transfer services rapidly. They typically offer:

In 2025, many companies choose white-label platforms because they can enter the market quickly and compliantly, without building everything from scratch. A small portion of this article references RemitSo, a white-label ecosystem known for fast deployment and enterprise-grade compliance tooling. This is included for context, not as the main focus.

In-house development means building an entire remittance infrastructure internally, including:

This route offers complete control and flexibility—but it requires time, expertise, and extremely high long-term costs.

Below is a detailed breakdown comparing both paths using EEAT-backed industry perspectives.

White label platforms typically allow a new MTO or fintech to launch in 3–6 weeks, depending on:

Because all core systems already exist, companies focus mainly on customization and licensing approvals.

Building a remittance platform from scratch averages:

Delays often occur due to:

Slow time-to-market also results in lost revenue and higher opportunity cost.

Costs are predictable:

Expect major expenses, including:

A typical end-to-end build costs $350k–$1.5M+, followed by $40k–$120k per month in ongoing maintenance.

The FATF, FinCEN, and EU AMLA mandates require strict controls. Compliance failures can result in fines, license revocation, or business shutdown.

Vendors offer pre-integrated payout corridors, often 50–100+ countries.

You must negotiate with banks, aggregators, complete due diligence, integrate APIs, and build failover logic—this takes months per corridor.

Platforms are optimized for high volume, instant processing, and 99.9% uptime.

Requires DevOps teams, load balancing, failover, monitoring, and disaster recovery.

You must build admin panels, BI tools, and logging from scratch.

If speed, cost predictability, and compliance are priorities—white label is the best route.

RemitSo is an example of a modern white-label remittance ecosystem offering:

Both models are viable, but the best choice depends on your goals:

| If your goal is: | Best Option |

|---|---|

| Rapid launch | White Label |

| Lower upfront cost | White Label |

| Minimal engineering | White Label |

| Heavy customization | In-House |

| Full data ownership | In-House |

| Enterprise-grade control | In-House |

Most companies in 2025 choose white label due to:

In-house development is ideal, but only for organizations with very large budgets and long timelines.

If you're evaluating white-label vs in-house remittance technology, platforms like RemitSo can help you launch quickly with compliant, scalable infrastructure—without the cost and complexity of a full engineering build.

Need Help Launching Your Remittance Business?

It is a pre-built remittance platform that allows companies to launch money transfer services quickly without developing infrastructure internally.

Not necessarily. Security depends on expertise. White-label vendors often maintain ISO/SOC-certified infrastructures.

Typically 6–12+ months, depending on team size, integrations, and compliance complexity.

Most companies spend $350k–$1.5M+ upfront, plus $40k–$120k monthly for maintenance.

KYC, AML screening, sanctions checks, transaction monitoring, audit logs, and case management—per FATF and FinCEN requirements.

Yes, but customization levels depend on the vendor. Branding, workflows, and corridors are usually flexible.

White-label software—due to speed, lower cost, and built-in compliance.

Most platforms include 50–100+ pre-integrated corridors, reducing setup time significantly.