White Label

Remittance Software

Everything you need to operate as an international money transfer operator

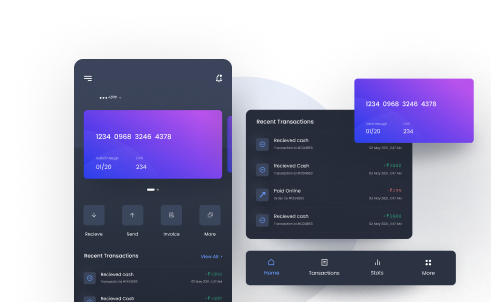

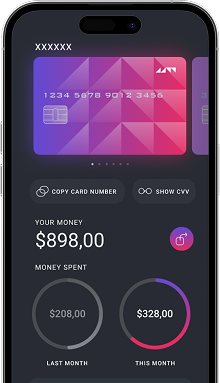

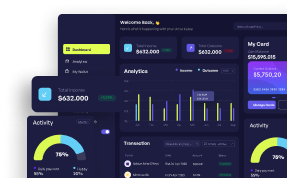

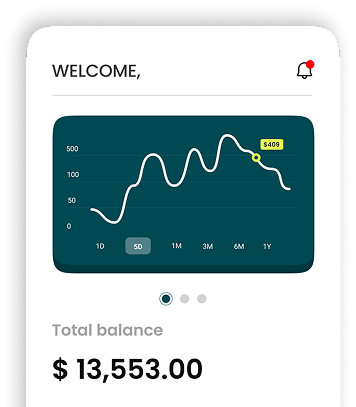

White Label Apps

Designed for a Superior Customer Journey

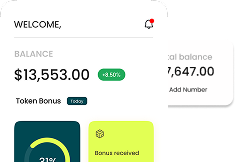

Simple & Fast Signup

We ensure your customers get a great start with a signup that is quick and easy. Features like fingerprint login make the entire journey feel simple for them.

Welcome Back

Don't have an account? Create one

Integrated Product Suite

Core software, KYC, and payout solutions all from a single partner

Verify Customer Identities Under $1

With Truoco, onboard customers instantly and securely without the high costs.

Learn More ➜

Manage Remittance Operations

With RemitSo's white-label software, manage transactions, monitor compliance, and oversee your branded customer apps.

Request Demo ➜

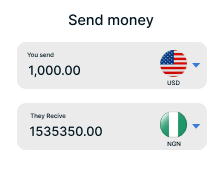

Simplify Payouts, with One Central Hub

With Velorem, a single API to simplify your entire payout operation, from funding to reconciliation.

Learn More ➜

Unique Vision, Build Bespoke

Achieve full ownership and infinite scalability to keep you ahead of the industry.

Learn More ➜From Launch to Global Scale

Complete ecosystem of tools, partnership & support

Start as a Money Transfer Business

Go live in the US, Canada, Australia, Brazil & the Eurozone in under 30 days. Even if you don't have a license, we've got you covered.

Global Partnerships

Leverage our pre-integrated network of essential services—including global payouts, payment gateways (pay-ins), and KYC providers.

Your Brand, Our Engine.

Launch your own remittance service with our licenses, banking, and technology.

MSB Bank Account

Struggling with high-street banks? We connect UK-based Money Service Businesses with stable, reliable banking partners who understand your needs.

Managed Compliance

End-to-end compliance support—from initial required licensing paperwork and program design to ongoing management and independent reviews.

Industries We Serve

Banks

Embed white label remittance capabilities via APIs into core banking platforms to diversify service offerings and revenue streams.

Learn More →

Neo Banks

Expand product offerings with robust core banking modules to offer one stop financial services to your customers

Learn More →

Credit Unions

Provide your members, seamless and secure way to send money to loved ones overseas.

Learn More →

Fintechs

Enhance your product offerings, compete globally all while delivering global end-to-end financial experience for your customers

Learn More →

Money Service Businesses

Manage core remittance operations and scale as neo bank bespoke development capabilities on top.

Learn More →

Exchange Houses

Offer a complete suite of cross-border payment solutions,

generate new revenue opportunities

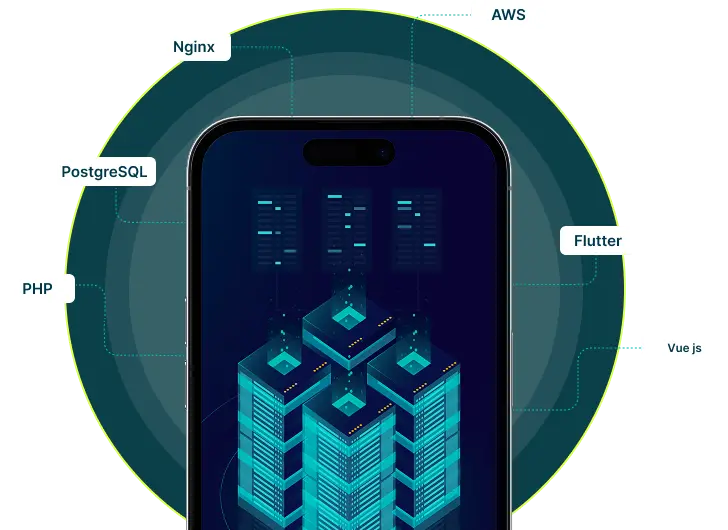

Technology Overview

Architecture

Built on the reliable AWS cloud leveraging, AWS SQS/SNS/SES

Performance & Reliability

AWS Lambda for serverless computing, RDS databases, and S3 for storage

Updates & Stability

Laravel Vapor for smoother updates, greater stability, efficient user experience

Engineered for Scalability

AWS Lambda and asynchronous processing (SQS), to handle high transaction volumes and manage peak times.

Trusted by companies worldwide

We’re Here to Help

Questions? We’ve got answers. Whether it’s a quick query or a detailed request, our team is ready to assist you through the method that suits you best.

Resource Hub

Articles, Insights, FAQs and More