For decades, the Money Service Business (MSB) model has been straightforward: build trust, offer competitive rates, and be the most reliable channel for customers to send money home. Your app likely does this brilliantly.

But there's a problem. Your customer's journey doesn't end after they press "send." They leave your app and immediately open another to pay a utility bill, another to top up a mobile phone, and yet another to order groceries for their family.

Every time they leave, you lose an opportunity. You've done the hard work of acquiring that customer and building that trust, only to hand them off to another service for their next transaction. This is the single-purpose trap.

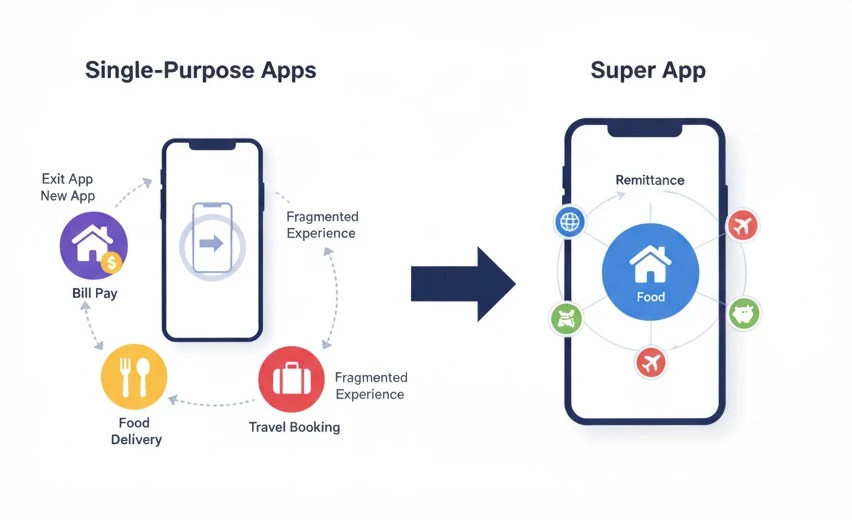

"Super App" gets thrown around a lot, but at its core, it's simple: it's an ecosystem, not a tool. It's an app that becomes the single entry point for a user's daily digital life.

Think about it. Your remittance app is the perfect foundation. Why? Because you've already solved the single hardest problem in fintech: trust. Your customers trust you with their hard-earned money. This trust is your license to offer them more.

Unlike a ride-hailing or food delivery app that had to bolt on financial services, you are *already* a financial service. You are at the center of your customer's most important transactions.

Expanding isn't just an offensive move to capture new revenue; it's a defensive one to protect your core business.

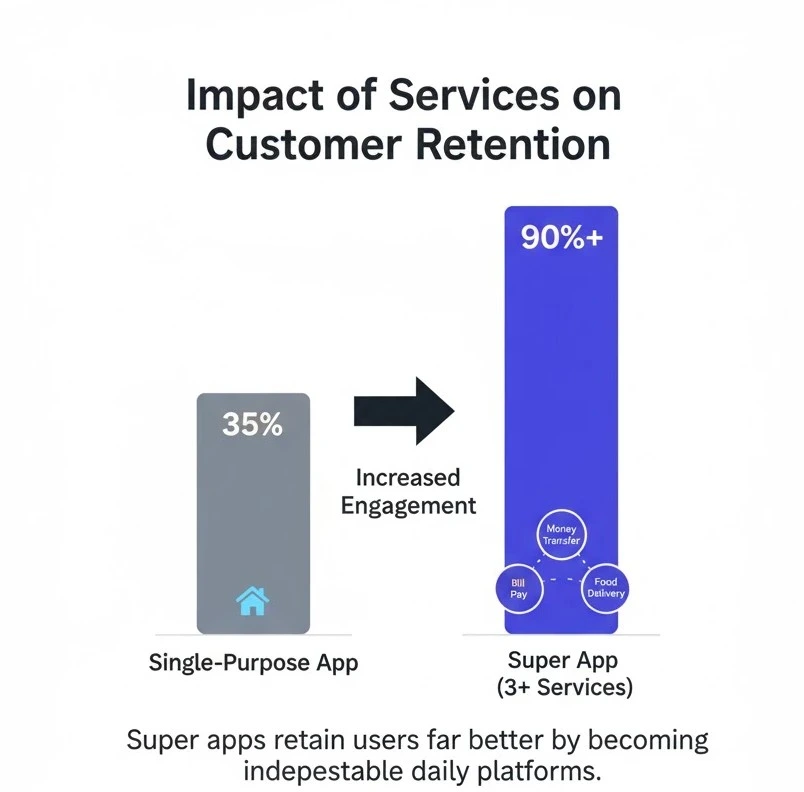

Leading research from Bain & Company shows that in financial services, when a user engages with three or more services on a single platform, retention rates can skyrocketing to over 90%. This is a level of "stickiness" a single-service app simply cannot achieve.

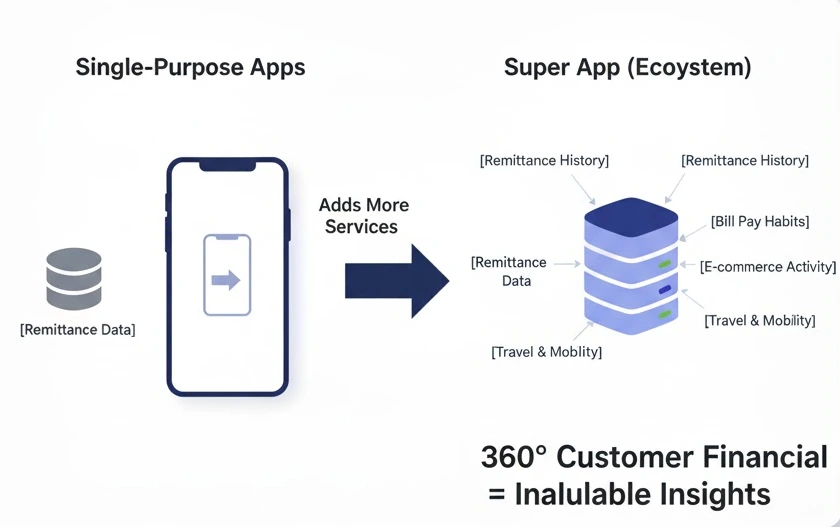

Yes, new services mean new revenue streams—a commission on every bill paid, a percentage of every mobile top-up. That's the obvious win. But the long-term value is even greater.

When your app solves five of a user's daily problems instead of one, your "stickiness" skyrockets. The friction of switching to a competitor becomes immense. Why would they leave? They'd have to replace five apps, not just one. This transforms your customer retention and dramatically increases lifetime value (LTV).

Right now, you know how much money your customer sends. Imagine also knowing their monthly bill-pay cycle, their mobile provider, their favorite online shops, and their travel habits. This data is gold. It allows you to personalize offers, cross-sell services, and build a truly 1-to-1 relationship, all while they remain in your app.

When your brand evolves from a "money-sending tool" to an "everyday life platform," your customer's perception changes. You become an indispensable partner. This "halo effect" strengthens your brand's position in the market and builds loyalty that no competitor can buy.

This evolution doesn't have to mean building ten new businesses from scratch. The modern approach is about smart integration. It's about leveraging APIs and white-label platforms to plug these services directly into the app your customers already know and trust.

The question isn't whether your customers need these services. They are already using them. The only question is whether they will be using them inside *your* app, or someone else's.

The shift to a Super App is a strategic journey. If you have ideas or are exploring how to integrate new services into your existing platform, we'd love to talk. We specialize in developing and integrating the vision for next-generation financial ecosystems.

Have an idea for your Super App?