Setting up a financial business in countries like India, the United States, or the UK can be complex due to strict regulations. That’s why many global businesses are choosing New Zealand for financial operations. The country offers a transparent regulatory environment, an efficient registration process, and strong international credibility.

If you're planning to offer services like money transfers, lending, or investment advice, you'll need to apply for a Financial Service Provider (FSP) license in New Zealand.

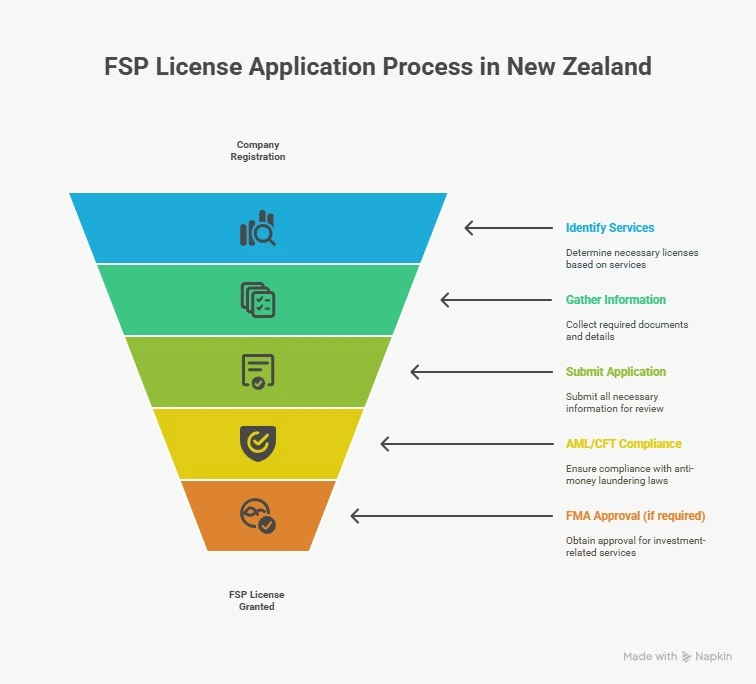

In this guide, we’ll walk you through the complete FSP application process in New Zealand, using clear steps, key requirements, and real examples.

A Financial Service Provider license allows a company to legally offer financial services in New Zealand. This can include services such as:

The license is managed by the Financial Markets Authority (FMA) and must be recorded on the FSP Register.

If you're looking to enter the New Zealand financial sector, whether you're based in India, the UK, or anywhere else, this license is often a legal requirement.

You need to register as a financial service provider in New Zealand if:

1. Register Your Company

Before applying for an FSP license, you must complete your financial company registration in New Zealand. You can register through the New Zealand Companies Office.

You’ll need to provide:

2. Identify the Services You Will Offer

Clearly define what services your company will provide. This helps determine whether you need just an FSP license New Zealand or also an additional FMA license.

| Service | FMA Approval Required |

|---|---|

| Money transfer / remittance | No |

| Investment advice | Yes |

| Managed investment schemes | Yes |

| Peer-to-peer lending | Yes |

| Crowd funding | Yes |

If your business will manage customer investments or issue financial products, you’ll need FMA approval.

3. Gather and Submit Required Information

During the FSP application process New Zealand, you’ll need to provide information on:

You’ll also need to explain your planned financial activities and include a basic business plan.

To get a financial license in NZ, these are the typical documents you will need:

New Zealand has strong anti-money laundering laws. Your business must comply with the Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT) Act.

You’ll need to:

To remain registered, your company must meet a minimum threshold of business activity in New Zealand. This includes:

| Requirement | Minimum |

|---|---|

| Number of clients | At least 10 per year |

| Transaction value | At least NZ$10,000 total |

If your business is newly registered, you must meet at least half of this threshold within six months.

Here are the typical costs involved in FSP registration in New Zealand:

The registration timeline depends on your business type and whether you need an FMA license. On average:

A global fintech company successfully registered as a Financial Service Provider in New Zealand in 2024. This allowed them to offer services like cross-border payments, virtual accounts, and prepaid cards in the local market.

Their entry into New Zealand helped expand operations across Oceania and reinforced their reputation in regulated markets.

If your business offers similar services, following this model is a proven path to global credibility and growth.

The FSP process can be confusing, especially for overseas companies. A financial licensing consultant in New Zealand can help you:

Applying for an FSP license New Zealand is a key step for any company planning to offer financial services in the country. It helps you meet legal requirements, build customer trust, and expand safely into the New Zealand market.

If you're an entrepreneur or company from India, the UK, the US, or elsewhere, New Zealand offers a modern, compliant, and opportunity-rich environment for financial growth.

At RemitSo Compliance, we help you through every step of the process to register a financial service provider in New Zealand.

Whether you're local or global, our goal is to help you get your financial license in NZ without stress or delays. Visit www.remitso.com to get started today.

It’s a legal license that allows a company to offer financial services such as payments, lending, or investments. It must be registered on the FSP Register and sometimes requires FMA approval.

Register your company, select your services, prepare documents, meet compliance rules, and submit your application to the FSP Register.

You need a registered company, local address, qualified personnel, AML compliance, and proof you’ll meet minimum client and revenue thresholds.

Yes. Many overseas companies from India, the UK, and the US register successfully. You’ll need a local business address and to follow New Zealand’s rules.

If you're new to New Zealand’s system, yes. A financial licensing consultant New Zealand can save you time, avoid errors, and help you get licensed faster.