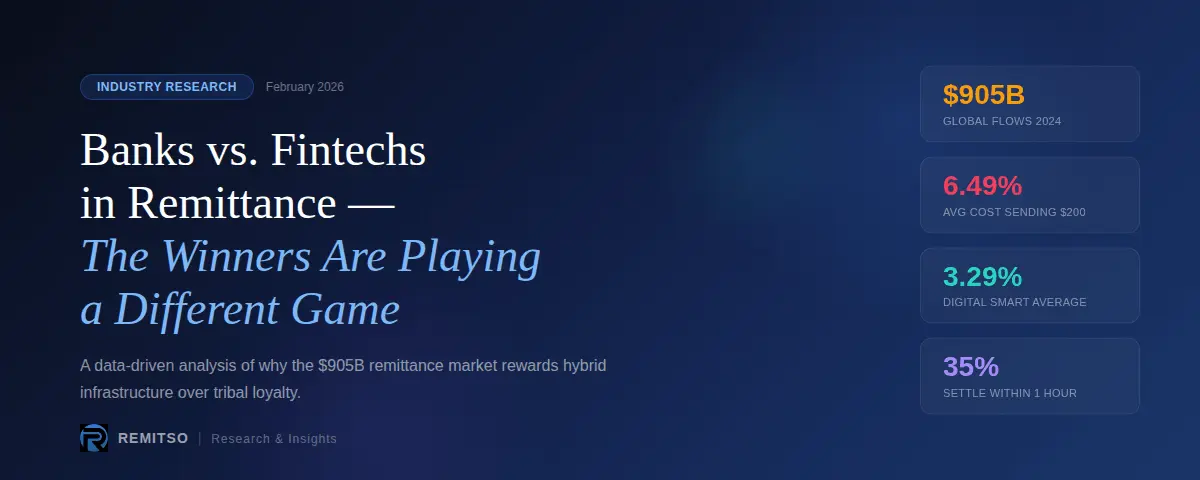

Banks vs. Fintechs in Remittance: Why the Real Winners Are Building Hybrid Models

For the better part of a decade, the remittance industry has been framed as a zero-sum contest: agile fintechs on one side, legacy banks on the other, and a trillion-dollar market hanging in the balance. The narrative is compelling. It is also incomplete.

When you step away from the headlines and examine the data published by the world's leading multilateral institutions, a different picture emerges. The operators making the most meaningful gains are not the ones choosing a side. They are the ones assembling hybrid infrastructure that combines the regulatory credibility and settlement depth of traditional banking with the speed, modularity, and user-centric design of digital-first platforms.

This blog takes a data-driven look at where the global remittance market stands in early 2026, what the institutional benchmarks reveal about progress (or the lack of it), and why the hybrid model is no longer a strategic preference but an operational imperative.

The Scale of the Opportunity: A $905 Billion Market

Global remittance flows reached an estimated $905 billion in 2024, representing year-on-year growth of 4.6 per cent from $865 billion in 2023, according to the World Bank and the International Organisation for Migration's Migration Data Portal. Remittances to low-and-middle-income countries (LMICs) alone reached approximately $700 billion in 2024, as reported by the United Nations Department of Economic and Social Affairs (UN DESA).

A few numbers underscore the scale of this market and why it matters:

- Remittances exceed FDI and ODA combined: For developing economies, remittance inflows now surpass the combined total of net foreign direct investment and official development assistance, making them the single largest source of external financing. (Source: UN DESA, November 2025 Briefing)

- Sustained long-term growth: The U.S. Federal Reserve, in a February 2025 research note, confirmed that global remittances have shown a steady upward trajectory since the late 1990s and projected that widening income disparities, demographic pressures, and climate-driven migration will sustain this growth for decades.

- Not a shrinking pie: For money transfer operators (MTOs), banks, and fintechs alike, this is an expanding market that rewards intelligent collaboration — not a shrinking one that demands aggressive competition.

The Cost Challenge: Stuck at 6.49 Per Cent

Despite years of innovation, the global average cost of sending $200 in remittances stood at 6.49 per cent in Q1 2025, according to the World Bank's Remittance Prices Worldwide (RPW) report, Issue 53. That figure represents a decline of roughly 3.2 percentage points since 2009, when it was 9.67 per cent, but it remains more than double the United Nations Sustainable Development Goal (SDG) target 10.c of reducing remittance costs to under 3 per cent by 2030.

Figure 1: The cost of sending $200 varies dramatically by channel and region. Digital-first services average 4.85%, less than half the Sub-Saharan Africa corridor cost. Source: World Bank RPW Issue 53, Q1 2025.

The regional and structural gaps are significant:

- Sub-Saharan Africa (close to 9%): The cost of sending $200 to Sub-Saharan Africa averaged close to 9 per cent in Q1 2025 — nearly three times the SDG target — making it one of the most expensive regions for remittance recipients globally. (Source: World Bank RPW & UN DESA November 2025 Briefing)

- $20 billion in lost value: The World Bank estimates that if the SDG 3 per cent target were achieved globally, recipient households would retain an additional $20 billion each year — money that currently vanishes into transfer fees.

- Digital vs. non-digital gap: Digital remittance services averaged 4.85 per cent in Q1 2025, compared to 7.16 per cent for non-digital services, underscoring the cost advantage of technology-driven channels. (Source: World Bank RPW, Issue 53)

Digital Channels: Proof of Concept, Not Yet Proof of Scale

There is a bright spot within the data. The World Bank RPW report's SmaRT (Send Money and Receive Transparently) index, which measures the cost of services meeting baseline standards for speed, accessibility, and transparency, recorded a global average of just 3.29 per cent in Q1 2025. Meanwhile, 76 per cent of corridors covered in the RPW database had SmaRT corridor averages below 5 per cent.

The challenge, however, is penetration. Digital services accounted for only 29 per cent of all remittance services tracked by the World Bank in Q1 2025. The technology to meet global targets exists — but it is not yet the default experience. What is missing is the infrastructure to make it universally accessible:

- Digital identity ecosystems: Robust, interoperable digital ID frameworks that streamline KYC across corridors and reduce onboarding friction for migrant senders, enabling them to access affordable digital channels from day one.

- Interoperable payment rails: Instant payment systems linked across borders, enabling real-time settlement without reliance on slow and expensive correspondent banking chains. The BIS CPMI is actively supporting initiatives such as Nexus Global Payments to interconnect national fast payment systems.

- Harmonised regulatory frameworks: Standardised AML/CFT rules and licensing reciprocity across jurisdictions that allow operators to deploy services rapidly in new corridors without rebuilding compliance infrastructure from scratch.

- Open API ecosystems: Modular, standards-based APIs — including ISO 20022 data harmonisation — that enable banks, fintechs, and non-bank payment providers to interoperate seamlessly and share pre-validated payment information before funds are sent.

The G20 Roadmap: Ambition Meets Reality

In 2020, the G20 launched a Roadmap for Enhancing Cross-Border Payments, coordinated by the Financial Stability Board (FSB) in collaboration with the Bank for International Settlements' Committee on Payments and Market Infrastructures (CPMI). In 2021, the G20 endorsed quantitative targets to be met by end-2027, covering cost, speed, transparency, and access.

The FSB's Consolidated Progress Report for 2025, published in October, offered a candid assessment. While major international policy milestones have been achieved, the report notes that these efforts have not yet translated into tangible improvements for end-users at the global level.

Figure 2: G20 cross-border payment targets vs. actual performance. All four metrics remain significantly below 2027 targets. The FSB has acknowledged the timeline is unlikely to be met. Sources: FSB Progress Report Oct 2025, BIS Bulletin 2025.

Key findings from the 2025 assessment:

- Speed shortfall (35% vs. 75% target): Only 35 per cent of global cross-border retail payments are credited within one hour of initiation, against the G20 target of 75 per cent. For wholesale and remittance payments, that figure reaches 55 per cent — still well short of the benchmark. (Source: BIS Bulletin, 2025)

- Cost progress described as "sticky": The global average cost of sending remittances remains at 6.49 per cent, with some improvement in the most expensive regions but progress described by the FSB as "sticky" overall. (Source: FSB Consolidated Progress Report, 2025)

- 2027 targets unlikely to be met: The FSB itself acknowledged that it is unlikely that satisfactory improvements at the global level will be achieved in line with the 2027 Roadmap timetable, citing the complexity of payment platforms, protracted jurisdictional implementation, and inconsistent private sector support.

- Policy complete, implementation lagging: The majority of international policy development work has been completed. The bottleneck is now at the jurisdictional level — individual countries need to adopt and implement the agreed standards, from ISO 20022 messaging to harmonised API frameworks.

Why the Hybrid Model Is Winning

These institutional assessments point to a structural reality the industry is slowly internalising: neither banks nor fintechs, operating in isolation, possess all the capabilities required to meet the G20's vision of faster, cheaper, more transparent, and more accessible cross-border payments.

Figure 3: The hybrid infrastructure model. Winning corridors combine bank-grade compliance and settlement with fintech-grade speed and user experience. Analysis based on FSB G20 Roadmap, BIS Bulletin, World Bank RPW 2025.

The case for hybrid infrastructure becomes clear when you examine what each side brings:

- What banks bring to the table: Settlement accounts, regulatory licences across jurisdictions, balance-sheet liquidity, and deep compliance infrastructure. The BIS and FSB progress reports consistently reference these as foundational layers without which cross-border payment reform cannot advance.

- What fintechs bring to the table: Simplified onboarding, transparent pricing, reduced settlement times, and API-first architectures designed for modularity and rapid corridor deployment. The FSB's own roadmap highlights the role of harmonised APIs and ISO 20022 data standards — concepts that digital-native platforms have been building around from inception.

- What the winning corridors have in common: Interoperable instant payment systems, mature digital identity infrastructure, open API ecosystems, and a regulatory environment that permits non-bank operators to participate alongside traditional institutions. This is the blueprint for hybrid infrastructure — and it is the direction that the most forward-looking operators are pursuing.

New Headwinds: The U.S. Remittance Tax and Tightening Migration Policy

The operating environment is also shifting beyond pure technology and infrastructure. Several macro-level factors are introducing new volatility into remittance corridors:

Figure 4: Policy shifts introducing corridor volatility in 2026. The U.S. remittance tax and tightening migration controls are reshaping flow patterns. Sources: U.S. IRS, CGD, IIF, UN DESA 2025.

- U.S. Remittance Tax (1%, effective January 2026): The United States introduced a 1 per cent tax on all outbound remittances, as confirmed by the U.S. Internal Revenue Service. Preliminary research from the Center for Global Development estimates this levy could reduce U.S. remittance outflows by approximately 1.6 per cent, with disproportionate effects on remittance-dependent economies in Central America and the Caribbean, including El Salvador, Guatemala, Haiti, Honduras, and Jamaica.

- Tightening migration controls: As the UN DESA November 2025 briefing notes, stricter migration policies in major host countries are introducing volatility into remittance flows. The Institute of International Finance estimates that inflows to Latin America could decline by more than 10 per cent in 2026 compared to 2024 levels.

- Corridor-level volatility: Nigeria saw remittance inflows peak in 2024 but experienced a 4.2 per cent decline in Q1 2025 as softening global growth reduced job opportunities abroad. Egypt, by contrast, saw a sharp recovery after adopting a flexible exchange-rate regime in March 2024. (Source: UN DESA, November 2025)

For operators, this means the ability to rapidly adjust corridor coverage, pricing, and compliance posture is no longer a competitive advantage — it is a survival requirement.

The Road Ahead for Money Transfer Operators

The evidence from the world's leading multilateral bodies is unambiguous. The $905 billion remittance market is growing. The cost and speed of cross-border payments remain stubbornly behind global targets. Digital infrastructure has proven it can deliver results — but only where it is layered onto robust regulatory and financial foundations.

For MTOs navigating 2026 and beyond, the strategic imperatives are clear:

- Assemble, don't rebuild: The question is not whether to be a bank or a fintech. It is how quickly you can assemble the right stack — compliance, payouts, KYC, and user experience — without rebuilding each layer from the ground up.

- Prioritise interoperability: Operators that invest in ISO 20022 compliance, API-first architecture, and multi-rail settlement will be positioned to benefit as national payment systems begin linking across borders.

- Build for corridor volatility: The U.S. remittance tax, tightening migration policy, and shifting exchange-rate regimes demand platforms that can pivot corridor coverage and pricing rapidly, without months of re-engineering.

- Partner for credibility and scale: The operators that will capture disproportionate value in the years ahead are the ones building — or partnering to access — hybrid infrastructure that is modular enough to adapt and credible enough to scale.

The future of remittance is not bank or fintech. It is bank and fintech — working through platforms that bring the best of both worlds together for the one billion people who depend on cross-border transfers every year.

Want to see how a ready-made hybrid platform can accelerate your growth?

Book a demo or consult with us at RemitSo today to see how our platform can power your growth.

Request Demo →

Sources

All data in this article has been sourced exclusively from government portals and multilateral institutional publications:

- World Bank: Remittance Prices Worldwide, Issue 53, March 2025 (remittanceprices.worldbank.org)

- International Organisation for Migration: Migration Data Portal, Remittances Overview, 2025

- United Nations DESA: World Economic Situation and Prospects: November 2025 Briefing, No. 196

- U.S. Federal Reserve: Global Remittances Cycle, FEDS Notes, February 2025

- Financial Stability Board: G20 Roadmap for Cross-border Payments: Consolidated Progress Report, October 2025

- Bank for International Settlements: BIS Bulletin — Enhancing Cross-border Payments: State of Play and Way Forward, 2025

- United Nations: SDG Indicator 10.c.1 — Remittance Costs as a Proportion of the Amount Remitted

- U.S. Internal Revenue Service: Treasury/IRS Guidance on Remittance Transfer Tax, 2025

- Center for Global Development: Even at 1%, the US Remittance Tax Hits Poor Countries Hard (Dempster, Ward & Huckstep, 2025)

- Institute of International Finance: U.S. Migration Shocks and Remittances (Estevão et al., 2025)